(Posting from phone - doesnt recognize paragraph breaks).

Deutsche bank had a mini ex marine nazi queen in her fur coat and her men dressed in black harass and violate my 1st amendment rights along with Occupy Wall Street so I googled DB Nazis and find out DB financed the build of Auschwitz, IG Farben the gas and Dr Mengele and his experiments. Did some research and anyone that survived being operated on and I met a survivor who as a boy was medical tortured - experiments on his spine -- he wouldn't take reparations but DB and Germany government compensate only as slave labor! Thanks Deutsche Bank for having vile Nazi like ex marines too cowardly to confess their employer -- you and their names. See my Triology DB The Scream. DB and Amanda Burden did you own public toilets yet 60 Wall St POP? http://www.theominousparallels.blogspot.com/2012/03/is-sec-covering-up-wall-street-crimes.html?m=1

SUNDAY, MARCH 4, 2012

Is the SEC Covering Up Wall Street Crimes? Duhhh

Excerpt from Tiabbi piece on SEC illegally shredding evidence!!!

I, Suzannah, copied and pasted the one section on the SEC and Deutsche Bank dirty play.....

"Flynn responded to Khuzami with a letter laying out one such example of misbehaving lawyers within the SEC. It involved a case from very early in Flynn's career, back in 2000, when he was working with a group of investigators who thought they had a "slam-dunk" case against Deutsche Bank, the German financial giant. A few years earlier, Rolf Breuer, the bank's CEO, had given an interview to Der Spiegel in which he denied that Deutsche was involved in übernahmegespräche – takeover talks – to acquire a rival American firm, Bankers Trust. But the statement was apparently untrue – and it sent the stock of Bankers Trust tumbling, potentially lowering the price for the merger. Flynn and his fellow SEC investigators, suspecting that investors of Bankers Trust had been defrauded, opened a MUI on the case.

A Matter Under Inquiry is just a preliminary sort of look-see – a way for the SEC to check out the multitude of tips it gets about suspicious trades, shady stock scams and false disclosures, and to determine which of the accusations merit a formal investigation. At the MUI stage, an SEC investigator can conduct interviews or ask a bank to send in information voluntarily. Bumping a MUI up to a formal investigation is critical, because it enables investigators to pull out the full law-enforcement ass-kicking measures – subpoenas, depositions, everything short of hot pokers and waterboarding. In the Deutsche case, Flynn and other SEC investigators got past the MUI stage and used their powers to collect sworn testimony and documents indicating that plenty of übernahmegespräche indeed had been going on when Breuer spoke to Der Spiegel. Based on the evidence, they sent an "Action Memorandum" to senior SEC staff, formally recommending that the agency press forward and file suit against Deutsche.

Breuer responded to the threat as big banks like Deutsche often do: He hired a former SEC enforcement director to lobby the agency to back off. The ex-insider, Gary Lynch, launched a creative and inspired defense, producing a linguistic expert who argued that übernahmegespräche only means "advanced stage of discussions." Nevertheless, the request to proceed with the case was approved by several levels of the SEC's staff. All that was needed to move forward was a thumbs-up from the director of enforcement at the time, Richard Walker."

skip to main |

skip to sidebar

mayor bloomberg, de Blasio I call Bloomed Blasio, Ray Kelly, Campisi, Bratton, Reznick, O'Neill Know a lot about fixing crime don't they?

CityTime will be bigger trial than Haggerty Trial where Mike Bloomberg a sitting mayor committed perjury and Team Bloomberg -- Pat Harris, Kevin Sheekey, Allison Jaffin, Fiona Reid all suffered terrible bouts of amnesia. I wish Dennis Vacco has called Steve Rattner Fiona Reid's boss to the stand. NY1 fires camera man/news reporter for filming Rudin Condo Sales office Protest We Need a Hospital! Call and ask NY1 to do the right think and re-hire him! 212-NY1-NEWS (212-691-6397). email newspix@ny1.com See bottom of blog: I moved everything down to bottom of blog.

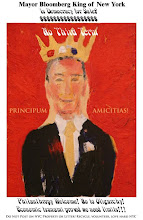

Mayor Bloomberg King of New York NO THIRD TERM! Your philanthropy is welcome! by Suzannah B. Troy This site is devoted to voting no to a third term. NYC is oligarch central. Using youtube as art, street poster art asking "Is Democracy for Sale?", branching out w/ low budget protest- NYC style. In contrast, king Mike made billions despite the economic tsunami and has unlimited resources. My goal is to make you think and feel; that is my job as an artist!

Mayor Bloomberg Ray Kelly Protected NYPD Fixing and Favors My Case Included

mayor bloomberg, de Blasio I call Bloomed Blasio, Ray Kelly, Campisi, Bratton, Reznick, O'Neill Know a lot about fixing crime don't they?

See bottom of Blog to see info Unions, Wiki page, Vote Quinn OUT! etc.

See my YouTubes & Blog Postings on CityTime Corruption starting w/ May 27, 2010 Suzannah B. Troy's 1st YouTube on CityTime calling for NO renewal w/ SAIC and a full investigation!!! Reminder: Rudy gave us SAIC & CityTime (We didn’t need either-Mike ran with it Tax Payer’s Titanic)

http://youtu.be/F3OLAgH1MJg May 4, 2009

Don't believe the news, New Yorkers are angry & will not vote for BLOOMBERG! Note: Mayor Bloomberg and his top deputies & key staff all took immunity in the Haggerty trial. Why? Mike Bloomberg broke campaign laws and committed perjury Haggerty Trial. Next the CityTime Trial with Team Bloomberg suffering amnesia yet again! Stay tuned! Vote for Christine Quinn if YOU want Mike to have a 4th term from the golf course! In front of SAIC NY offices demanding way more than 600 million $ back for The People of NYC !http://youtu.be/5MgD4ncQF18 Letter in Defense of Suzannah's YouTube Channel GoogleE-Burka by Louis Flores URGENT 911 Tech System ECTP Criminal Investigation Needed! http://mayorbloombergkingofnewyork.blogspot.com/2012/09/citytime-ectp-yell-down-mayor-bloomberg.html?m=1

Mike Yelled down Aug. 20 CityTime and ECTP 911 Tech

NYPD Coerced me to drop charges or go to jail with a hole in my retina Saturday arrest for Dr Fagelman's savagely violent receptionist Delita's running punch to my eye grabbing my hair trying to drag me down the hall by my hair damaging my neck not fired or arrested I agreed to false arrest Oct 16 immediate than Det John Vergona changed my false arrest date to Saturday oct. 20, 2012 4PM IAB let him and his supervisor retire! https://www.youtube.com/watch?v=dh9TedhfthE I am alleging fix, favors and retaliation -- please look at the first page -- it mentions HP tied to 911 Tech corruption as well as mayor Bloomberg Ray Kelly free rides Air Bloomberg....http://www.scribd.com/doc/188752042/NYPD-Commissioner-Ray-Kelly-Charles-Campisi-DI-Ed-Winski-Lt-Agnes-Lt-Angelo-Burgos-IAB-Sgt-Mary-O-Donnell-Sgt-Chen-Det-Andy-Dwyer-Det-John-Ve

Mayor Bloomberg King of New York

Blog Archive

-

▼

2012

(4070)

-

▼

March

(274)

- CityTime SAIC CNN Ireport Removed Here it is! Who ...

- NY Media Blacks Out NYC Unemployment Up 9.6 % High...

- Mayor Bloomberg Protest NYPD Well Behaved Stop An...

- Christine Quinn Greatest Shame Yet No Full Service...

- Andrew Cuomo Making Huge Mistake Cutting DiNapoli ...

- Misogynist NY Post Editors Call john liu LIAR but ...

- Mayor Bloomberg Cy Vance Resign Lies Misogyny + Ci...

- Keith Olbermann Fired Sex Addict Elliot Spitzer Re...

- Mayor Bloomberg Resignation 2012 about to break 3,...

- CityTime Scandal Not in the News Bloomberg SAIC Sh...

- Cy Vance Resign! Manhattan DA 1 Hogan Place NYC

- Cy Vance Resign Protests + NYC Gov Trend Defense C...

- More Puff Pieces Bloomberg Quinn CityTime SAIC Jel...

- NYPD Rape Cop Pena Calls for Llyod Constantine Dis...

- OWS Global Revolution headquarters shutdown by NYPD

- Mayor Bloomberg Tech Contracts NYC Gov all The Tax...

- Michael Bloomberg's Budget Proposal Elicits Protes...

- Christine Quinn Protest: Isaac Mizrahi Doesn't Nee...

- CityTime SAIC Lobbyists Sal Salamone Peter Powers ...

- Teflon Bruce Ratner Lobbyists Guilty 2 Criminal Tr...

- Mayor Bloomberg Christine Quinn Revolving Door Cor...

- Occupy Wall Street Going After Joe Crowley!!!

- Bloomberg CityTime SAIC Media Black-Out Another La...

- West Village Travesty Rudin Family Christine Quinn

- Bloomberg Protest Today

- NYPD Rape Cop Prison Cy Vance Resign!

- Grannies To Kid Shot in Cross Fire Rapes Up but it...

- Christine Quinn Rudin No Hospital Cy Vance CityTim...

- Cy Vance Must Go!

- Cy Vance Lloyd Constantine NYPD Rape Cop 2 Disast...

- Christine Quinn Caught in Lie Rudin Family $30,000...

- Mayor Bloomberg Cy Vance NYPD Rape Cops DA CityTim...

- Goldman Sachs is a racketeering entity from OverS...

- Huge Bloomberg Protest 2morrow?

- http://blogs.villagevoice.com/runninscared/2012/03...

- Christine Quinn Unairbrushed Votes For Rudin Condo...

- CityTime SAIC Bloomberg More Proof Black-Out! Dena...

- NYC Series Fatal Shootings Silence Uproar only if ...

- CityTime Media-Cover-ups No Arrests NYC Gov Joel B...

- The NY Times to Censor Suzannah Troy Again for Blo...

- The New Yorker Christine Quinn Mike's 4 and 5th Te...

- Christine Quinn Occupy Wall St. Quinn Taking Money...

- Goldman Sachs Thieves

- Barriers Union Square

- NY Media Dead! Bloomberg Taylor The Sex Tapes Not!

- Gerald Shargel Call Mike Bloomberg CityTime Trial ...

- NYPD Club OWS or Goldman Sachs Pick Goldman Sachs

- The NY Times Gives Steve Rattner Pay To Play Crook...

- Christine Quinn Caught in A Lie Rudin 30,000 Grand...

- Mayor Bloomberg Protest Less Than 24 Hours Away

- Wednesday Mike Learns He Can't Buy Popularity!!!

- CityTime SAIC Bloomberg Trial Time on Their Side C...

- Judge Alice Schlesinger Well Deserved Slap Upside ...

- John Sexton Naked? Vile NYU Pres Real Estate Dart...

- Occupy Wall Street May Day Art 2012 Escalate The S...

- Suzannah Troy Gets Another Invite Bloomberg Rally

- CityTime city crime Cover-ups Black Outs by Media ...

- Media Black Out Christine Quinn Locks Out Her Own ...

- Rewind Suzannah Troy Surrounded NYPD Bloomberg Thi...

- Google's Blogger Just Made Me Prove I am not a Mac...

- Christine Quinn Rudin St. Vincent's Luxury Condo C...

- Mayor bloomberg Protest Coming Soon

- Mayor Bloomberg Knucklehead Spends $ on Advertisin...

- Bloomberg Adminstration Anyone Not Stealing & Mari...

- Wendell Walters NYC Gov Thief Housing Preservation...

- Mayor Bloomberg Resignation 2012 Breasts CityTime ...

- Rudy Giuliani 9-11 Fraud CityTime Crime!

- Jon Corzine JailTime Bloomberg NYU John Sexton Jon...

- Bloomberg Dept of Building Exposed by Someone Othe...

- CityTime Scandal + Term Limits Enough to Take Down...

- Cy Vance Joe Tacopina Chad Venus Fly Trap Seigel V...

- Cy Vance Dave Patterson NYU WOR NYC Violence Towar...

- Mike Lupica Commish Kelly A Winner

- Occupy Wall Street Art May Day 2012

- Gerald Shargel Call Bloomberg CityTime Crime Trial!!

- NYPD 1st Precinct 6th Precinct Thank You 250 Broa...

- Mayor Bloomberg Forbids Food Donations to Homeless...

- Suzannah Troy Said Way Back When No To Renewal SAI...

- The Wall Street Journal Only Media to Not Censor S...

- OWS NYPD side show Real Revolution No Blood Shed

- Goldman Sachs Bloomberg's Best Client?

- Dear Gerald Shargel Call Mike B and Rose Gill Hear...

- WSJ CityTime Review, Suzannah Troy CityTime Down f...

- Christine Quinn Google Alert

- SAIC CEO Jumper Bullshite Letter No Longer Fronts ...

- SAIC Accounting Tricks But Shares May Fall Further

- Construction Worker Dead Columbia University Emmin...

- Bloomberg Media Sell Unemployment Lie!

- The NY Times Schills for Christine Quinn as Mayor ...

- Mike Bloomberg Anti-Social Media - Thugs Removed S...

- ECTP 911 Tech NASA Over 1 Billion Over Budget City...

- Mayor Bloomberg Infrastructures NYC

- Honey LaBronx Donny Moss Successful Christine Quin...

- Commissioner Kelly Would Easily Win Mayoral Race

- Amanda The People's Burden Commissioner City Plann...

- CityTime ECTP Hold Your Nose Stinks in the Billion...

- Glenn Hutchins Gartner and Bill to NYC Tax Payers?...

- NYPD the 99% Go To The Source The Oligarchs of NY

- Mike Bloomberg Rewards Culture of Failure NYC Gov ...

- CityTime Scandal Hits SAIC Hard but NY Media Prote...

-

▼

March

(274)

Mike Bloomberg must see YouTubes by Suzannahartist

http://www.youtube.com/watch?v=F3OLAgH1MJg

May 4, 2009 I said do not believe what the press

is telling you Mike Bloomberg may not win because of

voter anger! I was so right on. May 4, 2009!!!!!!!

Sept. 05, 2010 Mike Bloomberg does not want to

give up 63oo emails to Haggerty! Why hasn’t the DA served subpoena’s for all of Mike and his deputy mayors emails with Haggerty’s name? The technology king is

being brought down by emails! Amazing they haven't forced

him to turned over his emails!

Below king Mike with the help of his minion prevent the people of NY from voting on term limits 2 years in a row and extend term limits!!!!!

Mr. NYC blogspot.com's interview with Suzannah B. Troy

http://mrnyc.blogspot.com/2010/02/interview-suzannah-b-troy.html

He says Jane Jacobs and I would add Mae West and Janis Joplin.

When Mike Bloomberg says "Progress" we know he means get the moving van!

http://bloombergnewzzz.blogspot.com/

When Mike Bloomberg bought, oops, barely won his 3rd term spending a record amount of money for the most humilating win in NYC history, he said he would work twice as hard.

Does that mean we have to pay him $2 a year now?

On the John Gambling Show, he responded to me by saying just a few people feel the way Suzannah feels...

Do you think he got the message now...?

When Mike Bloomberg says Progress we know he means get the moving van.

In my poem I wrote before he and Amanda socialite mega millionaire city planner, the people's BURDEN, aided and abetted NYU in tearing down St. Ann's from 1847 which survived everything all these years but NYU's need and greed to mega dorm the East Village to death....I wrote at the very end of Buy Town, Stuy Town, affordable housing an oxymoron... about "I love NY but I just can't afford to live here T shirts"

Mike Bloomberg is the Peter Sellers character in "Being There", just above average intelligence and instead of a comedy, it is a horror movie.

Mayor Bloomberg's confidential memo

to NYPD Ms. Kim see to it the NYPD beat the press up

and a few bloggers critical of and I will make you

the first woman Police Commissioner! Love and kisses,

Mikey Bloomberg your little emperor of NYC xoxox

http://suzannahbtroy.blogspot.com/2011/11/confidential-memo-mayor-mike-to-di-kim.html

- City Budget Cries of Pain/Don't close our firehouses NYTimes

- Clayton Patterson NO Art info

- Develop Don't Destroy Brooklyn

- Dump Christine Quinn

- Fed Up New Yorkers!!!!

- http://angrynyer.com/

- http://bloomberg-tapes.blogspot.com/

- http://bloombergscandals.blogspot.com/

- http://devilwearsmarshalls.blogspot.com/

- http://en.wikipedia.org/wiki/William_M._Tweed

- http://forums.wsj.com/viewtopic.php?t=3887&sid=7af8acee8d8facc79fcfa2e40e32c6f7

- http://normansiegel.com/

- http://noticingnewyork.blogspot.com

- http://noticingnewyork.blogspot.com/

- http://nyc.is/

- http://nydailynews.com

- http://nytimes.com

- http://online.wsj.com/article/SB122412001244939117.html?mod=googlenews_wsj

- http://online.wsj.com/public/article_print/SB111457272166718054.html

- http://queenscrap.blogspot.com/2009/04/bloomie-scared-of-disabled-queens.html

- http://stopkingbloomberg.com/Recent_News.html

- http://truenewsfromchangenyc.blogspot.com/

- http://twitter.com/BloombergWatch

- http://unreadyny.blogspot.com/

- http://washingtonsquarepark.wordpress.com/

- http://washingtonsquarepark.wordpress.com/2008/04/30/in-the-news-daily-news-juan-gonzalez-mayor-bloombergs-union-square-park-restaurant-deal-tasteless/

- http://www.1010wins.com/Bill-Clinton-Declines-to-Endorse-Bloomberg-s-3rd-T/4151022

- http://www.blockbloomberg.com/

- http://www.chelseanow.com/cn_12/builtupcomplaintssome.html

- http://www.crainsnewyork.com/apps/pbcs.dll/article?AID=/20081019/FREE/810199997/1097

- http://www.crotchshotradio.com/

- http://www.dailygotham.com

- http://www.gvshp.org/_gvshp/index.htm

- http://www.myspace.com/saveconeyisland

- http://www.nofirecuts.com/html/peoples_firehouse.html

- http://www.nydailynews.com/blogs/dailypolitics/

- http://www.nydailynews.com/blogs/dailypolitics/2009/10/odds-and-ends-557.html

- http://www.nypost.com

- http://www.nypost.com/seven/12112008/news/regionalnews/council_in_lush_mess_143667.htm?CMP=EMC-email_edition&DATE=12112008

- http://www.nytimes.com/2004/08/21/opinion/l-police-and-fire-pay-raises-705802.html?scp=2&sq=Suzannah+B.+Troy&st=nyt&scp=4&sq=Suzannah%20B.%20Troy&st=cse&scp=2&sq=Suzannah%20B.%20Troy&st=cse

- http://www.politickerny.com/1368/elsewhere-palin-kennedy

- http://www.politickerny.com/2696/morning-read-bloombergs-popularity-spitzers-name-troys-rage

- http://www.stopcolumbia.org

- http://www.suzannahbtroy.blogspot.com/

- http://www.suzannahbtroy.blogspot.com/

- http://www.tenantplanet.org

- http://www.tenantplanet.org/

- http://www.thepromiseofnewyork.com/

- http://www.tonyavellaformayor.com/

- http://www.willetspoint.org/2009/04/tony-avella-true-politician-for-people.html

- Letter of the week Village Voice "Carbon Copy", ironic Mike Red Square Rosen is fighting from a top the Christa Dora, once a welfare building to prevent another red square next door by Singer.

- Lorcan Otway's photo of neighborhood and more

- New York Focus

- No Third Term, blogspot.com

- NY1 covers medium size water main break East Village one block from Cooper Union's supersizing of Studio building, think it is related?

- Queens Crap

- Quinn Report

- Room Eight

- Save the Lower East Side

- Term Limits Voice of the People The New York Daily News/I am for more term limits including senate & congress on down to community boards where we need to vote for the people that represent us. We need transparency &accountability.

- Wall St. Journal article NY will survive without Bloomberg

- Wall St. Journal article NY will survive without Bloomberg

- Washington Square Park Word Press

- You are a disgrace!

About Me

- Suzannah B. Troy artist

- Passionate letters published in The Financial Times re: Lucien Freud, my art and women's issues, The Wall St. Journal"Betrayal at Ground Zero", The Chief, The New York Times (9),Crains "NYU's Logo should be a dorm with a dollar", The New York Sun, The New York Post, The New York Daily News, Metro, AMNY, The Village Voice "Carbon Copy" letter of the week, Newsday, Jerusalem Post, my blog mentioned New York Mag Intelligencer neighborhood watch. Got speed bumps for Anna Silver School & doors for women's bathroom Tompkins. Donated my white blood cells twice to help a little girl fight Non-Hodgkins & man w/Lymphoma. Two hour process & you can only do it 12 x in your life. Too worn out to donate now. Way back Liz Smith mentioned me & my favorite zen quote "Live each moment as if your hair is on fire." which means live in the moment like it is your last aka live life passionately! I am really proud to say I have run 2 New York City Marathons!!! Also to have done volunteer work with pre-school handicap children at Rusk. NYTimes My YouTube work 1) Giuseppi Logan’s Second Chance 2)Mysterious Mr. Rechnitz

Visit Suzannahartist YouTube Channel and some websites...

See my YouTubes & Blog Postings on CityTime Corruption starting w/ May 27, 2010 1st YouTube calling for NO renewal w/ SAIC and a full investigation Reminder: Rudy gave us SAIC & CityTime (We didn’t need either-Mike ran with it Tax Payer’s Titanic)

here are just a few sites to check out...

This Wiki page on me was removed after being attacked by sock puppet accounts exposed by an Wiki Editor. The accounts were suspended but the page came down as well. Interesting. The page is about being censored! All my YouTubes were banned and my YouTube channel removed a month and half before the election after relentless aggravated harassment by YouTube accounts identifying themselves on behalf of Mike Bloomberg. Google wrote me an apology and my account was restored 28 hours later.

Happy Holidays! Please Watch "Lay-off Time" (vs. "CityTime"-possible the biggest white collar crime NYC gov ever!!) where union workers & some city council sing to the tune of Silver Bells! http://www.youtube.com/watch?